Overview

Global Port State Control (PSC) activity in December 2025 comprised 6,229 inspections and 168 detentions, representing an aggregate detention rate of 2.70%. The Tokyo MoU carried the bulk of inspection volume (3,658 inspections) at a still below-average detention rate of 2.60%, while the Black Sea MoU remained the outlier at 6.03%, alongside a high average of 5.09 deficiencies per inspection. Compared with November 2025, deficiency levels increased in the Mediterranean and Abuja MoUs, eased in the Paris, Black Sea, and Indian Ocean MoUs, while the Tokyo and Caribbean MoUs remained broadly stable.

December closes a year marked by consistently elevated Port State Control activity, with enforcement outcomes remaining uneven across regions. Throughout the year, inspection volumes continued to be concentrated within the Tokyo and Paris MoUs, which together accounted for roughly three-quarters of all inspections. The Black Sea MoU repeatedly stood out as the key enforcement outlier, contributing a disproportionately high share of detentions relative to its inspection volume. The deficiency pro

file over 2025 remained largely stable, with Asset Certificates and Ballast Water consistently featuring among the leading categories. Overall, 2025 highlighted ongoing regional disparities in PSC outcomes and reinforced the importance of sustained compliance focus amid continued regulatory scrutiny.

Key takeaways

Tokyo and Paris MoUs account for ~76% of inspections and ~64% of detentions, whereas the Black Sea MoU contributes just ~6.4% of inspections yet ~14% of detentions.

The deficiency mix remained led by Ballast Water and Asset Certificates, which together represented >31% of total recorded deficiencies.

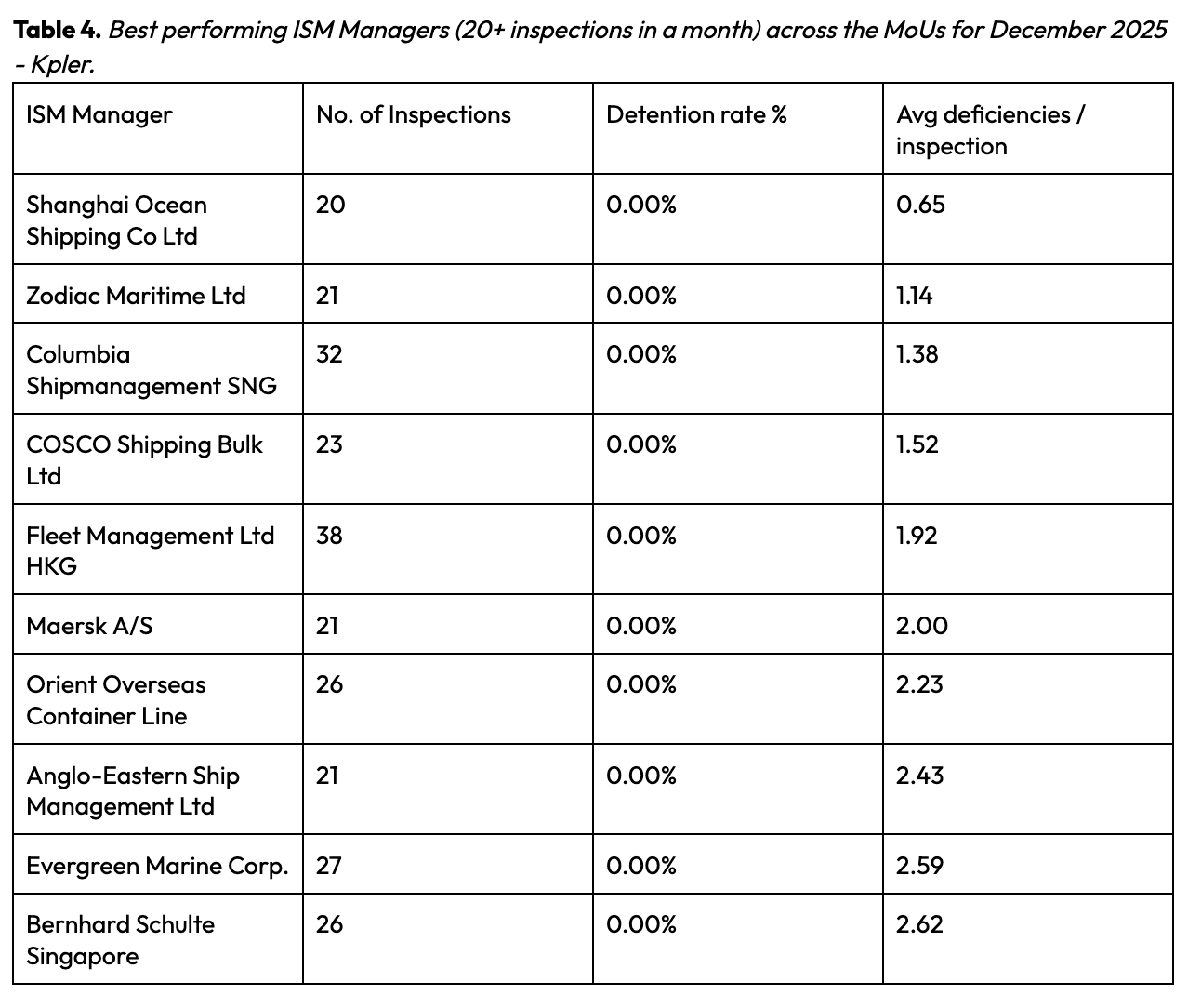

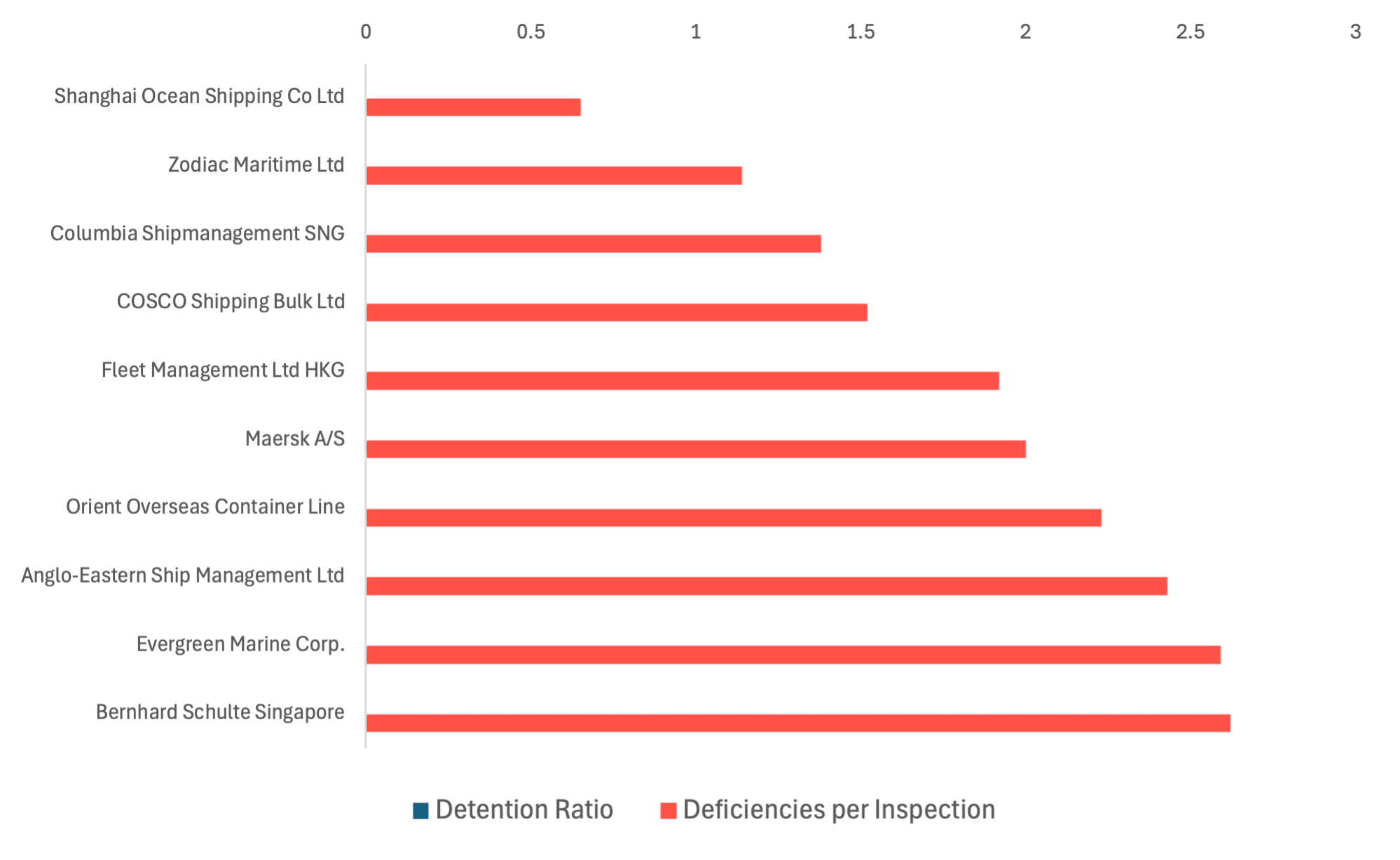

Shanghai Ocean Shipping Co Ltd, Zodiac Maritime Ltd, Columbia Shipmanagement SNG, COSCO Shipping Bulk Ltd, and Fleet Management Ltd HKG demonstrated strong compliance records, each maintaining <2.0 deficiencies per inspection.

Headline KPIs

In December 2025, Port State Control (PSC) authorities conducted a total of 6,229 inspections, resulting in 168 detentions, 19,174 recorded deficiencies, and 5 vessel bans. This corresponds to an aggregate detention rate of 2.70%, with an average of 3.08 deficiencies per inspection. The Black Sea MoU registered the highest detention rate at 6.03%, followed by the Mediterranean MoU at 5.14%, while the Caribbean MoU again reported no detentions during the period. In terms of inspection volume, the Tokyo MoU led with 3,658 inspections and accounted for the largest share of deficiencies (10,995). All 5 bans recorded in December originated from the Tokyo and Paris MoUs, with no bans reported across the remaining MoUs during the month.

Inspections vs Detentions by MoU

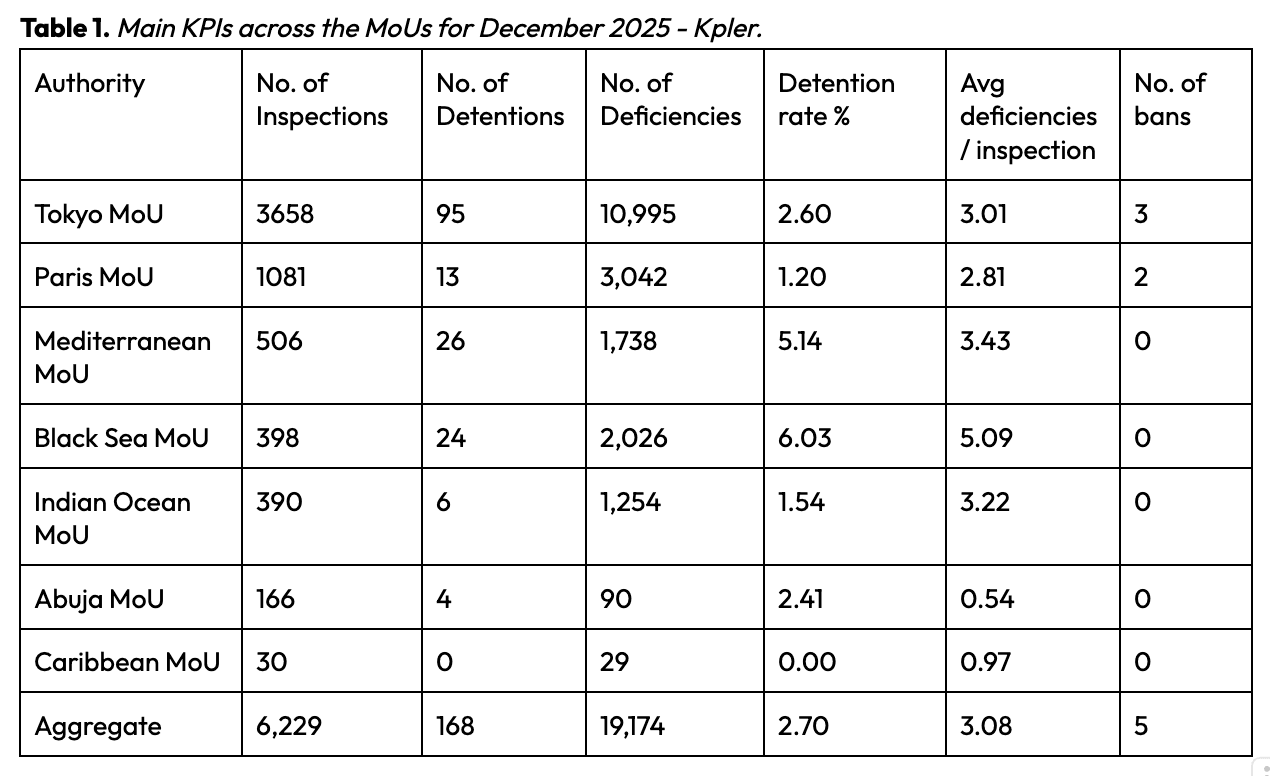

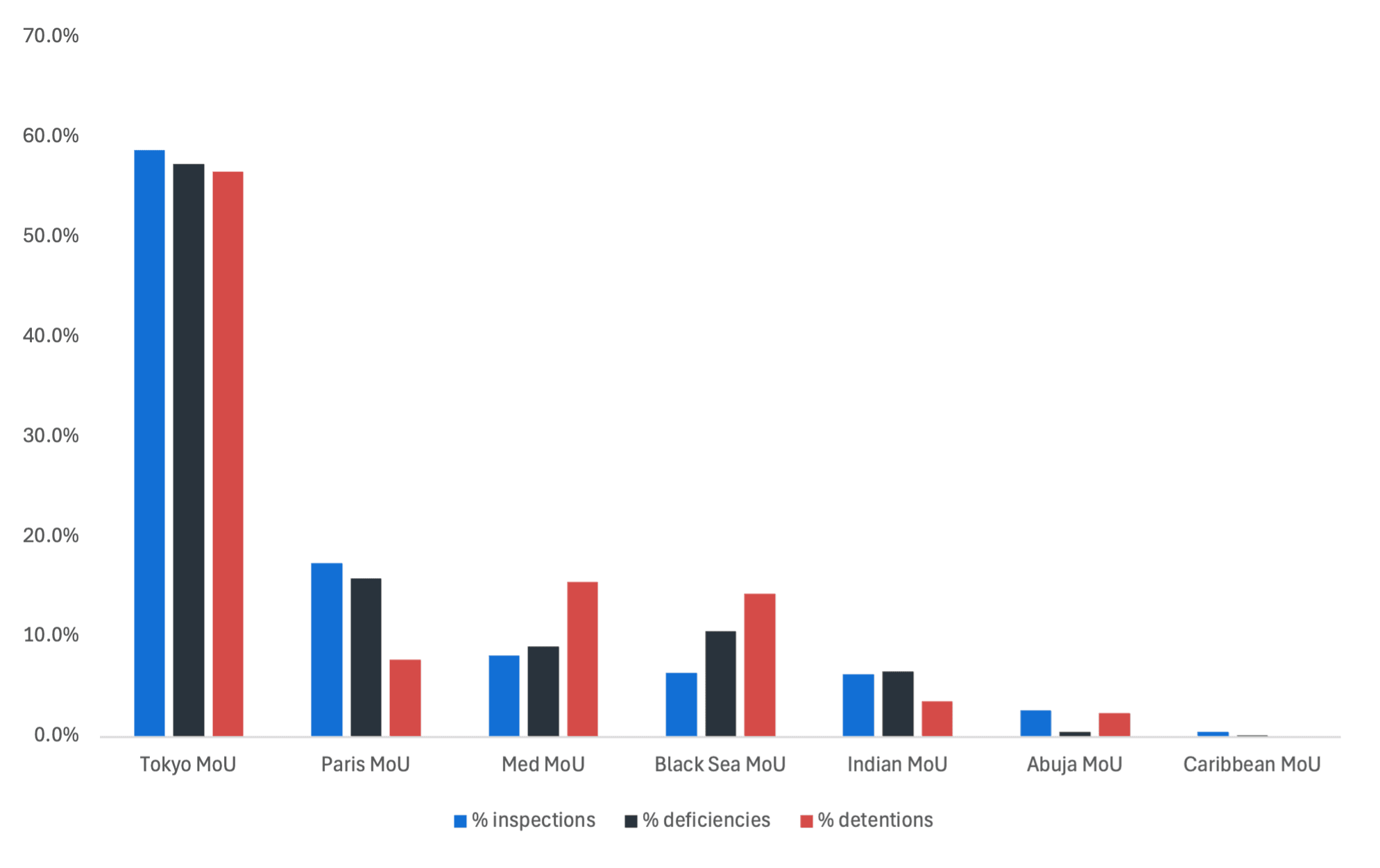

Graph 1. Distribution of Inspections, Deficiencies, and Detentions by MoU (% of all events across all PSCs, December 2025) - Kpler.

The Tokyo MoU continued to dominate overall PSC activity in December 2025, accounting for 58.7% of inspections, 57.3% of all recorded deficiencies, and 56.5% of detentions. The Paris MoU followed with 17.4% of inspections, alongside 15.9% of deficiencies and 7.7% of detentions. The Black Sea MoU, while representing only 6.4% of total inspections, contributed a disproportionately high 14.3% of detentions, underscoring the region’s persistently elevated enforcement intensity. The Mediterranean MoU also recorded a detention share of 15.5%, well above its 8.1% share of inspections. The Indian Ocean MoU represented 6.3% of inspections but accounted for only 3.6% of detentions, indicating a notably lower detention share relative to inspection activity. Meanwhile, the Abuja and Caribbean MoUs maintained minimal activity, together contributing just over 3% of inspections and 2.4% of detentions, underscoring their limited role in global PSC enforcement.

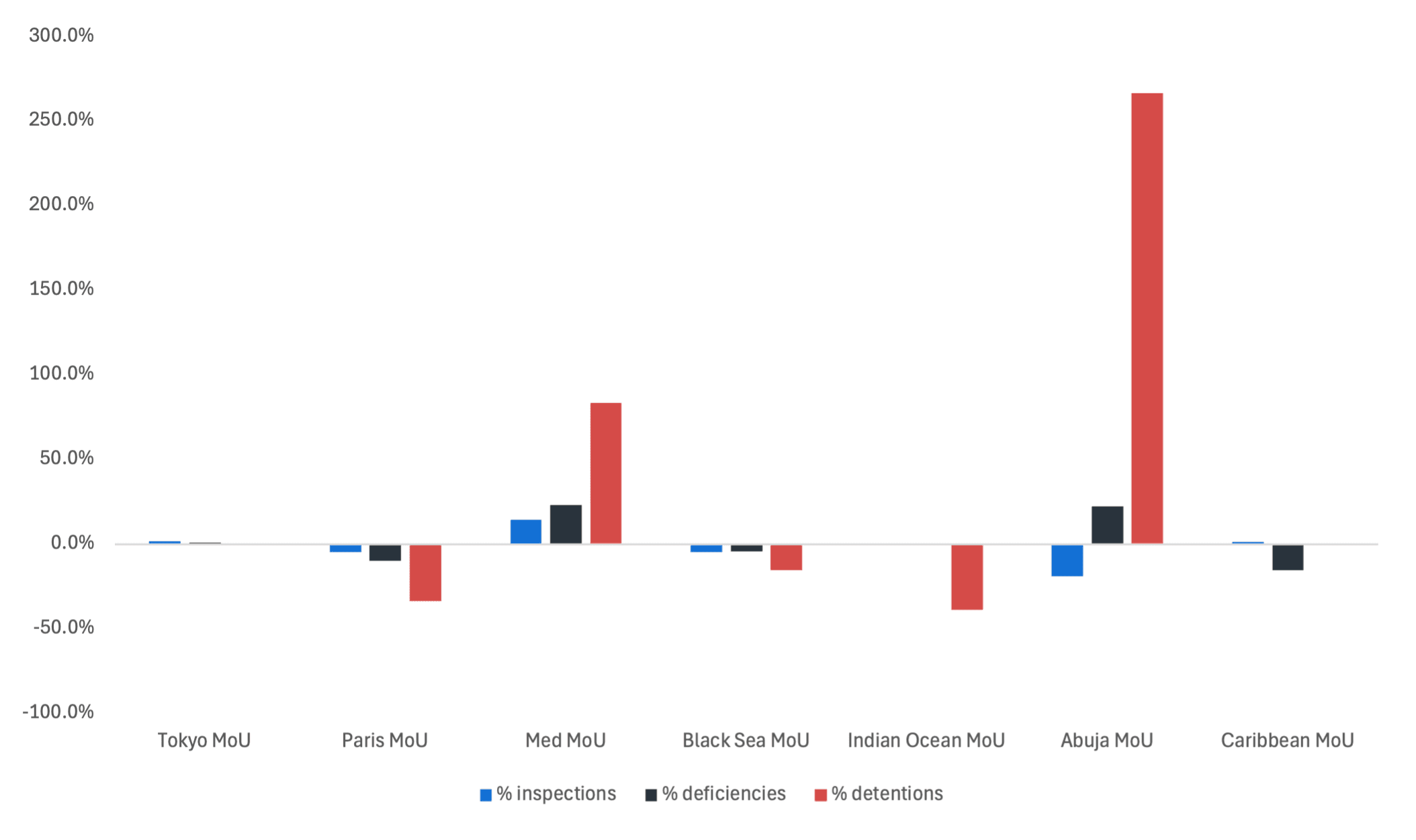

Graph 2. MoM Changes for December 2025 vs. September 2025 on Distribution of Inspections, Deficiencies, and Detentions by MoU (% of Aggregate) - Kpler.

The Tokyo MoU, which accounts for the bulk of global PSC activity, recorded only marginal month-on-month changes across inspections, deficiencies, and detentions, indicating broadly stable enforcement conditions. The Paris MoU saw declines across all three measures, with a notable reduction in detentions, while the Mediterranean MoU registered strong increases across inspections, deficiencies, and detentions, with detention shares rising sharply, pointing to a tightening in enforcement during the month. The Black Sea MoU experienced moderate declines across all three indicators, suggesting some easing from previously elevated levels. The Indian Ocean MoU showed broadly stable inspection and deficiency shares but recorded a sharp drop in detentions. Meanwhile, the Abuja MoU recorded a significant increase in detention share despite fewer inspections, whereas the Caribbean MoU saw only limited month-on-month movement, albeit from a lower baseline.

Detention-rate trend

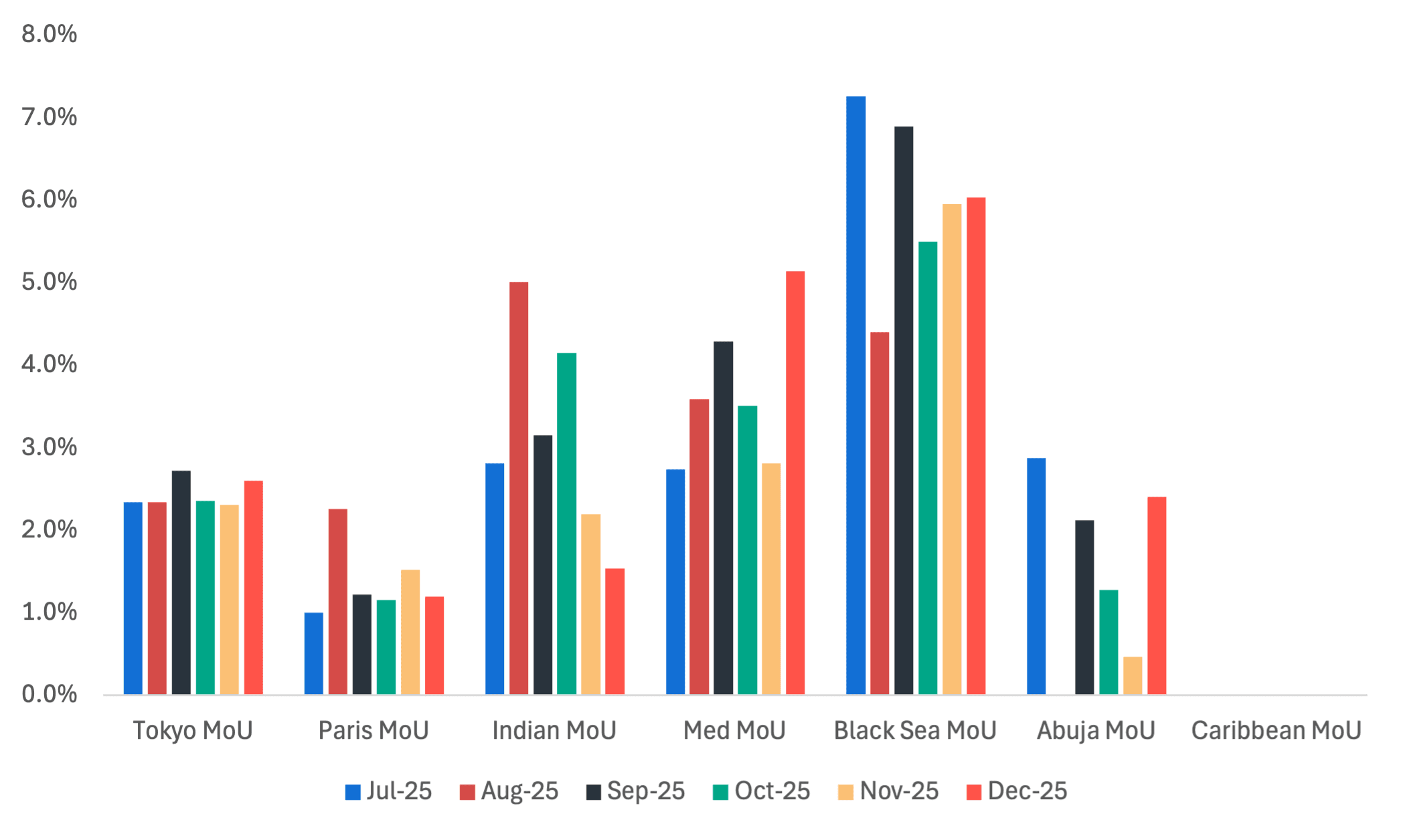

Graph 3. 6-Month Detention Rate Trends - Kpler.

The Black Sea MoU remained the region with the highest detention rate, holding steady at 6.03% in December. The Tokyo MoU continued to show relative stability, edging up slightly to 2.60% after several months of minor fluctuations. The Mediterranean MoU reversed its recent softening trend, rising sharply to 5.14% following a dip in November. The Indian Ocean MoU’s detention rate declined further to 1.54%, extending the correction from October. The Paris MoU edged down to 1.20%, remaining within a narrow range seen in recent months. The Abuja MoU increased to 2.41% after several months at lower levels, while the Caribbean MoU again reported no detentions, reflecting its limited inspection activity.

Deficiencies profile

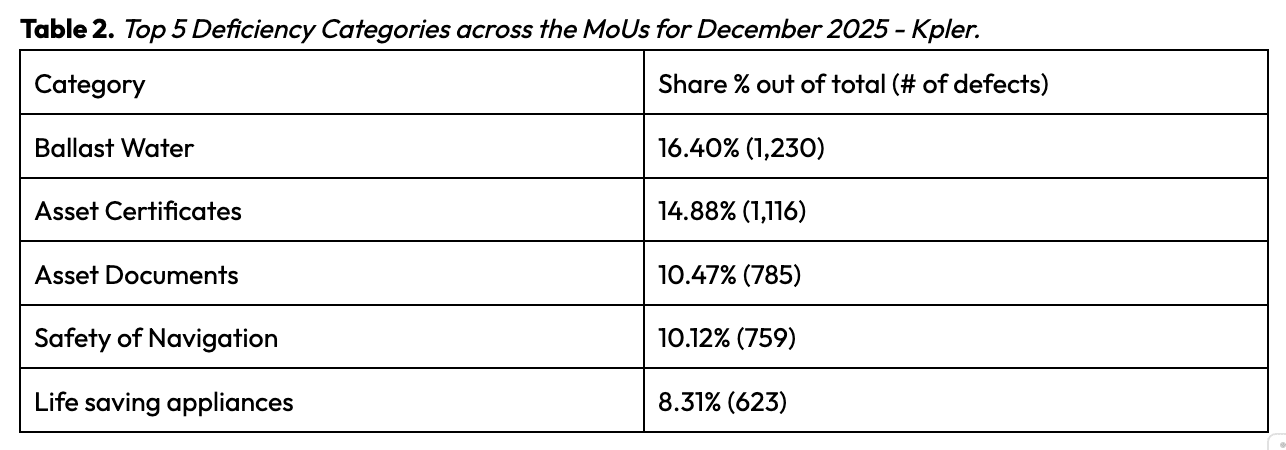

Ballast Water remained the leading deficiency category in December 2025, accounting for 16.40% of all recorded cases (1,230 deficiencies), reflecting continued focus on environmental compliance. Asset Certificates followed closely with 14.88% (1,116 cases), remaining a key focus area linked to statutory certification and regulatory approvals. Asset Documents contributed 10.47% (785 cases), while Safety of Navigation represented 10.12% (759 cases). Life-saving appliances rounded out the top five this month with 8.31% (623 cases). Collectively, these categories accounted for a substantial portion of total deficiencies across the MoUs, underscoring persistent operational and regulatory challenges.

PSC hotspots

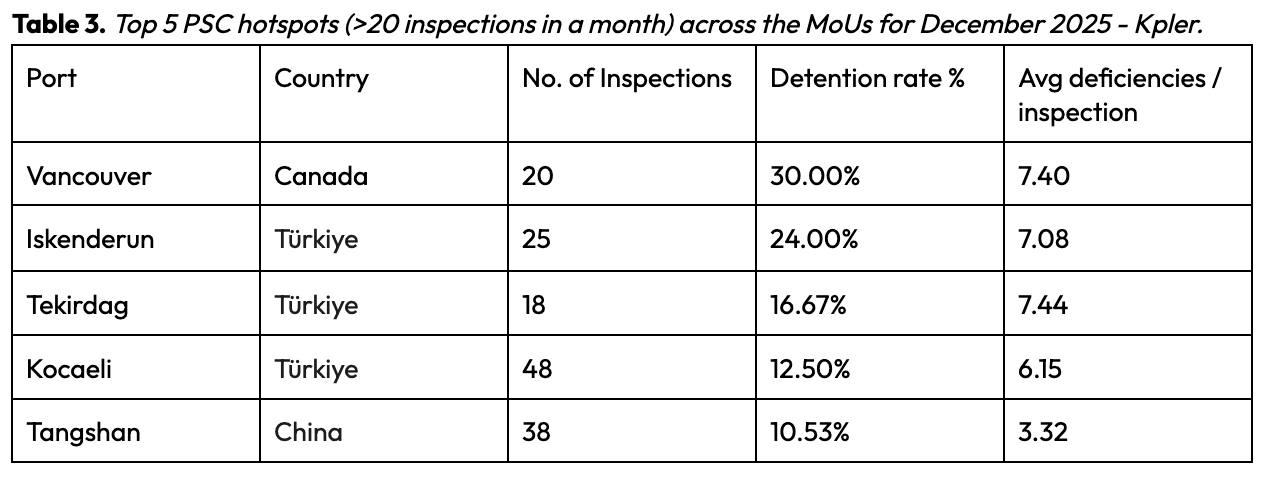

Vancouver (Canada) recorded the highest detention rate this month at 30.00%, with an average of 7.40 deficiencies per inspection, marking it as the port with the highest detention rate relative to inspection volume in December. Iskenderun (Türkiye) followed with a detention rate of 24.00% and a similarly elevated deficiency average of 7.08 per inspection. Tekirdag (Türkiye) registered a detention rate of 16.77%, alongside a high average of 7.44 deficiencies per inspection, while Kocaeli (Türkiye) recorded a detention rate of 12.50% with 6.15 deficiencies per inspection. Tangshan (China) rounded out the list with a detention rate of 10.53% and an average of 3.32 deficiencies per inspection. Overall, the identified hotspots reflect a broader geographical dispersion of elevated PSC enforcement activity during the month.

ISM Managers performance

Graph 4. Best ISM Managers’ performance (20+ inspections in a month) across the MoUs for December 2025 - Kpler.

Shanghai Ocean Shipping Co Ltd topped the list with the lowest deficiency level, averaging just 0.65 deficiencies per inspection across 20 inspections, reflecting strong compliance standards. Zodiac Maritime Ltd followed with 21 inspections and an average of 1.14 deficiencies per inspection, while Columbia Shipmanagement SNG also performed strongly, recording 32 inspections with 1.38 deficiencies per inspection. COSCO Shipping Bulk Ltd (23 inspections, 1.52 deficiencies per inspection) and Fleet Ship Management Pte Ltd (38 inspections, 1.92 deficiencies per inspection) continued to demonstrate consistent adherence to operational and safety requirements. Maersk A/S (21 inspections, 2.00 deficiencies per inspection), Orient Overseas Container Line (26 inspections, 2.23 deficiencies per inspection), and Anglo-Eastern Ship Management Ltd (21 inspections, 2.43 deficiencies per inspection) all delivered solid compliance results and remained fully detention-free. Evergreen Marine Corp. (27 inspections, 2.59 deficiencies per inspection) and Bernhard Schulte Singapore (26 inspections, 2.62 deficiencies per inspection) rounded out the list, underscoring the overall strong compliance performance across this group of established operators.

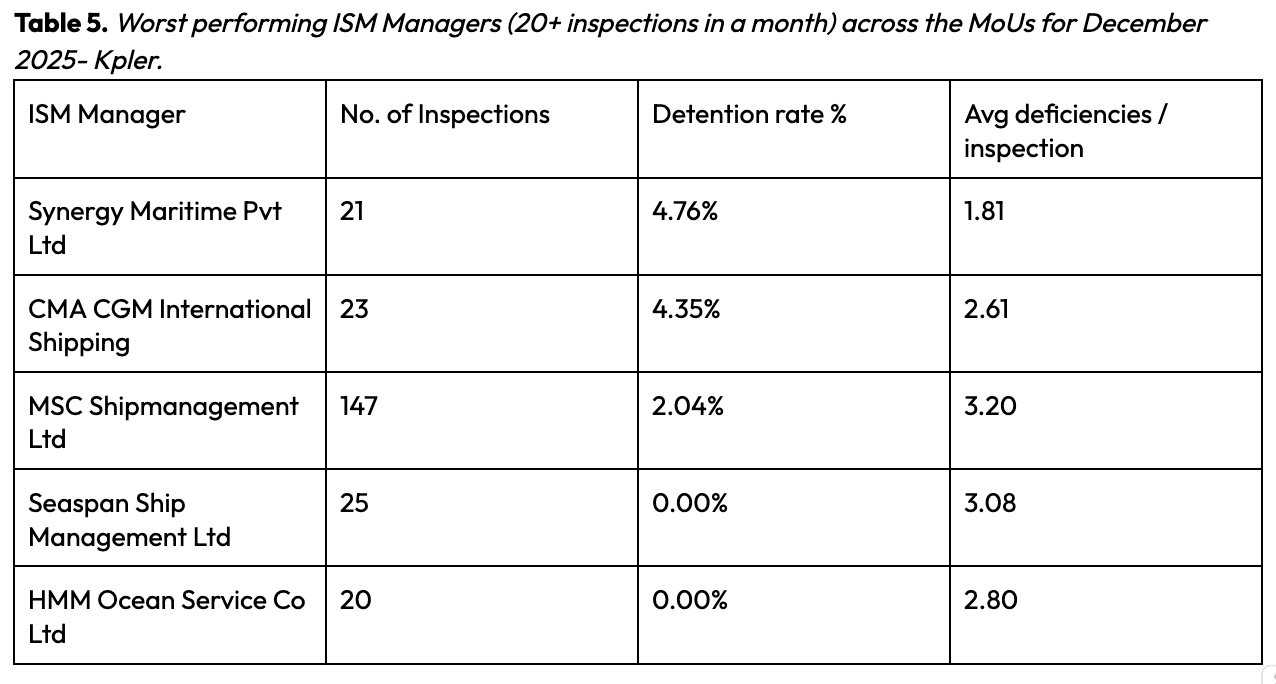

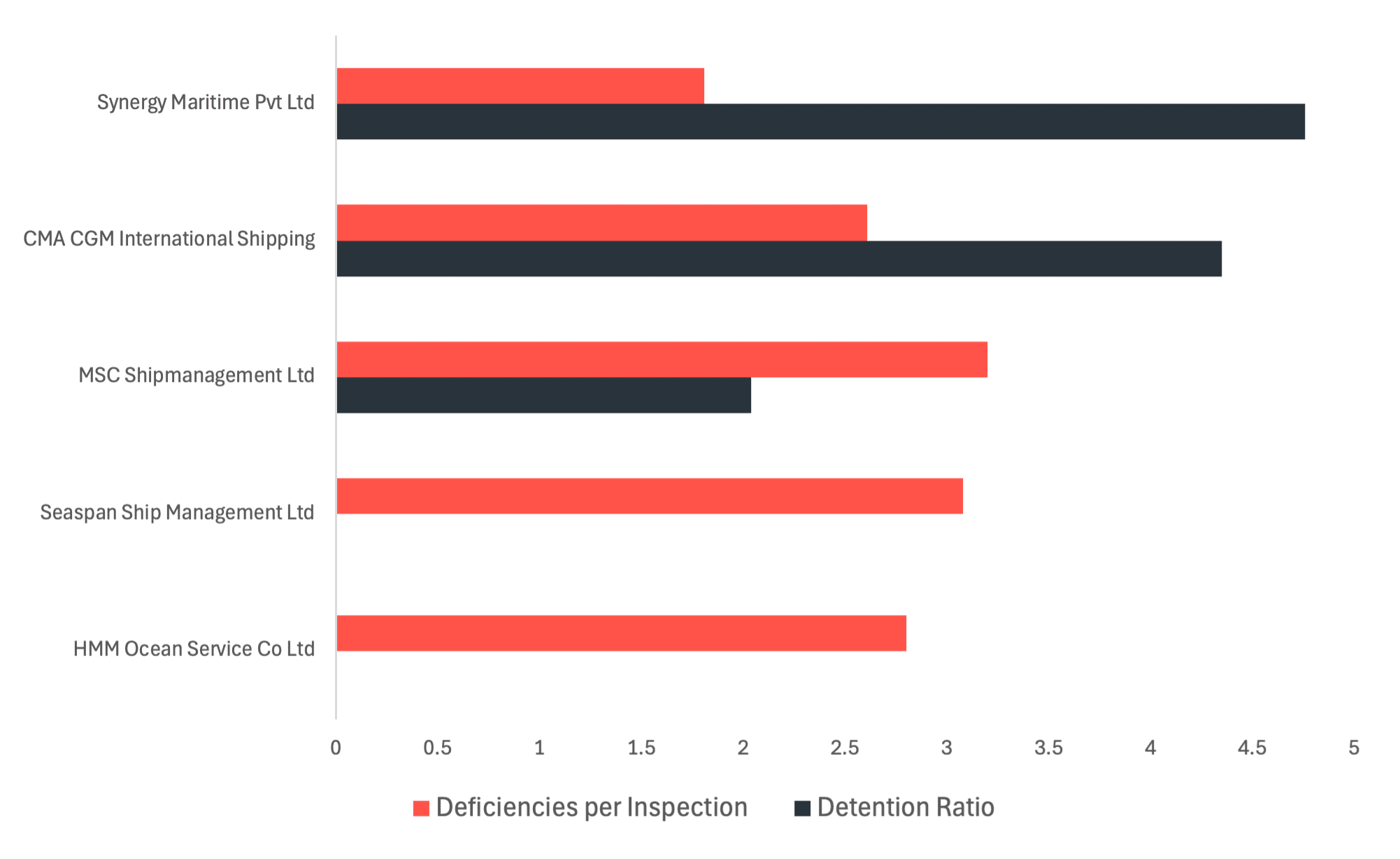

Graph 5. Worst performing ISM Managers (20+ inspections in a month) across the MoUs for December 2025- Kpler.

Synergy Maritime Pvt Ltd recorded the highest detention rate in December at 4.76% across 21 inspections, marking the weakest overall detention performance among major ISM managers during the month. CMA CGM International Shipping followed with a detention rate of 4.35% across 23 inspections, despite a comparatively lower average of 2.61 deficiencies per inspection. MSC Shipmanagement Ltd underwent the largest inspection volume at 147 inspections, resulting in a detention rate of 2.04% alongside an average of 3.20 deficiencies per inspection. While Seaspan Ship Management Ltd (25 inspections, 0.00% detention rate, 3.08 deficiencies per inspection) and HMM Ocean Service Co Ltd (20 inspections, 0.00% detention rate, 2.80 deficiencies per inspection) remained detention-free, both continued to record relatively elevated deficiency levels. Overall, the shorter list of weaker-performing ISM managers reflects fewer operators exceeding the 20-inspection threshold during the month.