Eastern Marine Service Co., Limited

Search

TitleAbstractContent

News and Events

NEWS

2021 ushers in uneven global bunker demand recovery,decarbonization

Source:PLATTS

|

Author:PLATTS

|

Published time: 2021-08-27

|

1677 Views

|

Share:

With just over four months of 2021 to go, global bunker fuel demand is on track to post a near 5% year-on-year rise as major bunkering hubs perform well, but still drastically lags 2019 levels as COVID-19 outbreaks continue to wreak havoc, global research and consulting company BLUE Insight’s director Adrian Tolson has told S&P Global Platts in an interview.

With just over four months of 2021 to go, global bunker fuel demand is on track to post a near 5% year-on-year rise as major bunkering hubs perform well, but still drastically lags 2019 levels as COVID-19 outbreaks continue to wreak havoc, global research and consulting company BLUE Insight’s director Adrian Tolson has told S&P Global Platts in an interview.

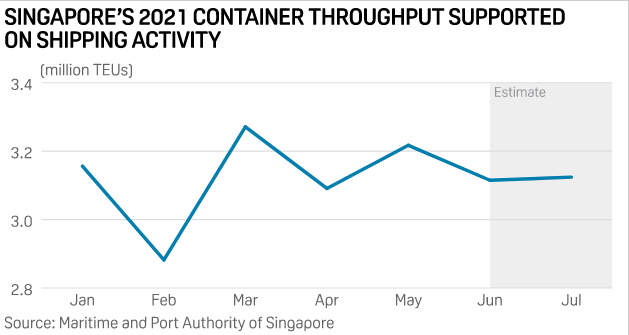

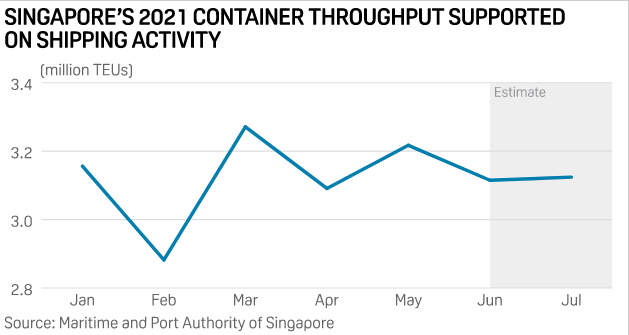

“Big ports continue to do well and we might even get a record in Singapore… that’s really all about container demand,” he said.

In addition to strong container activity, Singapore can provide competitive prices for all marine fuel grades, which most small and medium sized ports cannot, Tolson said.

In addition to strong container activity, Singapore can provide competitive prices for all marine fuel grades, which most small and medium sized ports cannot, Tolson said.

The city-port is also starting to receive some recognition for its work with mass flow meters as the shipping and marine fuel supply community increasingly tire of practices at some other supply ports, he said.

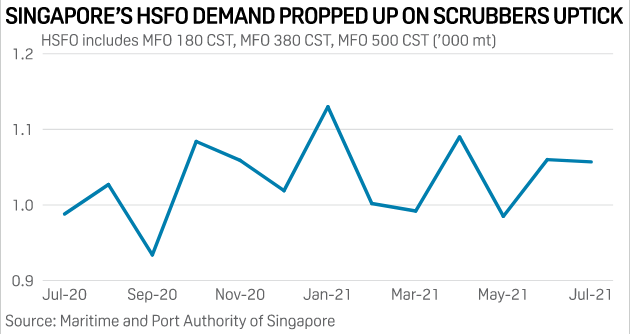

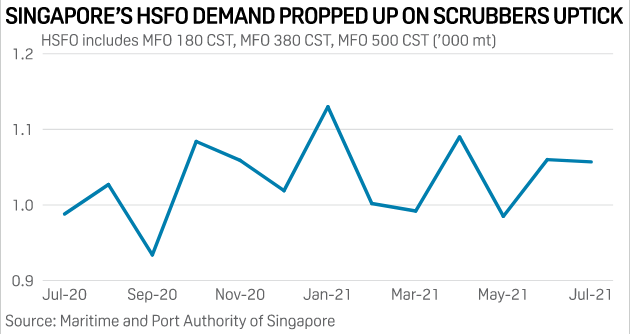

High sulfur fuel oil sales have also been strong in Singapore despite the shift to cleaner fuels.

Singapore's HSFO bunker sales, which include 180 CST, 380 CST and 500 CST grades, rose almost 7% year on year to 1.06 million mt in July, and comprised about 26% of total marine fuel sales in the month, data from the Maritime and Port Authority of Singapore showed. Singapore’s HSFO sales over January-July jumped 33.7% on year, the data showed.

“Well, it's [HSFO sales] driven by scrubber demand… this has slowed down, but even a spread of around $100/mt between HSFO and VLSFO makes sense for most scrubber investments on the larger ships,” Tolson said.

“However, as wash water discharge and environmental pressures build, we will in the next 2-3 years reach the peak of post-2020 HSFO demand and see a slow slide from then,” he said.

Scrubbers are only really an option for those vessels that are on the larger side and call at ports with good HSFO availability, capping overall HSFO consumption, he added.

Carbon tax, offsets aiding decarbonization

The International Maritime Organization in April 2018 laid out its strategy on greenhouse gas emissions, aiming to cut the shipping industry’s total emissions by at least 50% from 2008 levels by 2050, and to reduce CO2 emissions from transport work by at least 40% by 2030.

The International Maritime Organization in April 2018 laid out its strategy on greenhouse gas emissions, aiming to cut the shipping industry’s total emissions by at least 50% from 2008 levels by 2050, and to reduce CO2 emissions from transport work by at least 40% by 2030.

As for alternative fuels, LNG has obviously made an impact and, so far, is the only real volumetric success, due mostly to global container shipping company CMA CGM, Tolson said. LNG bunkers could well account for 10% of the total marine fuel mix well before 2030, he added.

In June, CMA CGM said that “between now and the end of 2024, 44 of the group's vessels will be powered by LNG.”

As for other options, there is a lot of focus on biofuels, which would be very easy to adopt, Tolson said.

Ammonia and methanol are other promising options, “but for these to be green, we have a very long way to go,” he added.

Pilot projects will be seen for other fuels, too, but most of these will not achieve scale until well into the next decade, he said.

Meanwhile, Tolson believes market-based measures will also be needed to incentivize the use of zero-carbon fuels. “They [fuel buyers/ship owners] will seek out the cheapest energy source and to make sure that is low or no carbon, we need to tax carbon in some way,” Tolson said.

“Once the incentive is there, we will see new fuels and, of course, the price will come down as well,” he said, adding that he was convinced that everyone in the supply chain would be “happy” to pay the extra cost, from shipper to end-consumer.

In the short term, carbon offsets will also help meet carbon neutral targets to some extent. However, this is not a real solution to decarbonization, and this mechanism is not likely achieve the goals that a carbon tax would, Tolson said.

“I am concerned about project oversight even though efforts are being made to address this by suppliers in our industry,” he added.

As these options grow in price and popularity, they will also likely be abused. A natural disaster like a forest fire will make some carbon offsets worthless, so perhaps offset projects will need to be more carefully chosen, Tolson noted.

So, before making predictions of lower carbon fuels making 20%-30% or more of the market by 2040, “we had better focus on efficiency, abatement and carbon capture,” Tolson said.

EASTERN MARINE SERVICE CO., LIMITED © 2019 All Rights Reserved

Terms of use | Legal/Privacy